What Is a Leveraged Volatility ETF?

So, you've heard about these leveraged volatility ETFs and are wondering what the big deal is. Maybe you're a trader looking for new ways to play the market, or perhaps you're just curious about how these things actually work. It's a bit like trying to understand how a complex engine runs – there are a lot of moving parts. We're going to break down what a leveraged volatility ETF is, how it's put together, and what you really need to know before you even think about putting your money into one. It’s not exactly like your average stock, that’s for sure.

Key Takeaways

- A leveraged volatility ETF is a type of exchange-traded fund designed to give you amplified exposure to changes in market volatility, often using derivatives.

- These ETFs typically rebalance daily, which can lead to compounding effects that might not always work in your favor over longer periods.

- The risks are significant; you can lose your investment quickly because the leverage magnifies both gains and losses.

- They are generally considered short-term trading tools, not buy-and-hold investments, and are best suited for experienced traders.

- When you're looking at these, check the specific index they track, the fees involved, and exactly how much leverage they use.

Understanding Leveraged Volatility ETFs

So, you're curious about leveraged volatility ETFs, huh? Let's break it down. Think of them as specialized investment products that aim to give you a bigger bang for your buck when it comes to tracking market volatility. They're not your typical buy-and-hold kind of investment; they're built for a different game entirely.

Defining Leveraged Volatility Exchange-Traded Funds

Basically, a leveraged volatility ETF is an exchange-traded fund that uses financial tools like derivatives and debt to amplify the daily movements of a volatility index. The goal is to provide returns that are a multiple of the index's performance. For instance, a 2x leveraged ETF would aim to double the daily return of its benchmark. It's a way to get magnified exposure to how much the market is expected to swing up or down. These are complex products, and you can find more about how they work on pages discussing leveraged exchange-traded funds.

The Mechanics of Volatility Tracking

These ETFs don't just magically know what volatility is doing. They typically track volatility indexes, like the Cboe Volatility Index (VIX). The VIX itself is a calculation based on the prices of S&P 500 index options. It's often called the "fear index" because it tends to rise when the market is falling and investors are worried. Leveraged ETFs use futures contracts on these indexes to get their exposure. It's a bit like trying to catch a fast-moving train – you need to be precise.

Leverage Amplification in Volatility Trading

This is where the "leveraged" part really comes into play. By using leverage, these ETFs aim to multiply the daily returns of the volatility index they track. So, if the VIX goes up by 5% on a given day, a 2x leveraged ETF tracking it would aim for a 10% gain. Conversely, if the VIX drops 5%, the ETF could lose 10%. This amplification is a double-edged sword, as it can significantly boost gains but also magnify losses. It’s important to understand that these products are designed to amplify daily performance, which can lead to unexpected results over longer periods due to compounding effects, a concept known as volatility drag.

For traders looking to get a handle on market sentiment and potential price swings, tools like BullX NEO Vision can be quite helpful. It offers customizable filters to spot trading opportunities, like tracking TVL spikes or new wallet activity, which can sometimes correlate with shifts in market volatility. You can explore its features for identifying trading opportunities.

Key Characteristics of Leveraged Volatility ETFs

Inverse and Leveraged Exposure

So, you're looking at leveraged volatility ETFs, huh? The first thing to get your head around is that these aren't your typical buy-and-hold investments. They're built to give you amplified exposure, meaning they aim to magnify the daily returns of a specific volatility index. This can be in the same direction as the index (leveraged) or the opposite direction (inverse). For instance, if you think volatility is going to shoot up, you might look at a leveraged long volatility ETF. Conversely, if you expect volatility to calm down, an inverse ETF could be your play. It's all about amplifying the daily moves of the volatility market. Think of it like this: a 2x leveraged ETF aims to deliver twice the daily percentage change of its benchmark index. This amplification is achieved through the use of financial derivatives, like futures contracts, options, and swaps, which allow the ETF to control a larger asset value than its net asset value would suggest. This is a key difference from traditional ETFs that simply hold the underlying assets.

Daily Rebalancing and Compounding Effects

This is where things get a bit tricky, and it's super important to understand. Leveraged volatility ETFs are designed to reset their leverage daily. What does that mean for you? It means that over longer periods, the actual return you get can be quite different from what you might expect based on the index's performance. This is due to something called compounding. Because the ETF rebalances daily to maintain its target leverage, gains and losses can compound in ways that might not be obvious. If the volatility index has a choppy day, going up and then down, or vice versa, the daily rebalancing can eat into your returns. This effect, often called "volatility decay," can really impact your investment over time, making these ETFs generally unsuitable for holding for extended periods. It’s why many traders use them for very short-term plays, sometimes just for a day or two.

The Role of Derivatives in Structure

How do these ETFs actually achieve that amplified exposure? It's all thanks to financial derivatives. These are contracts whose value is derived from an underlying asset, in this case, volatility. Funds like BullX often use futures contracts on volatility indexes, such as the VIX futures. These contracts allow the ETF to gain exposure to the expected future movements of volatility without actually owning the underlying assets. For example, a leveraged ETF might use futures contracts to gain 2x or 3x the daily exposure to the volatility index. The specific mix of derivatives used can vary between ETFs, and understanding this structure is key to grasping how they perform and the risks they carry. It’s a complex dance of financial instruments designed to track and amplify volatility.

Risks Associated with Leveraged Volatility ETFs

When you look at leveraged volatility ETFs, it's easy to get caught up in the idea of amplified returns. But you really need to understand the downsides, because they can hit you hard and fast. These aren't your typical buy-and-hold investments; they're built for short-term plays, and holding them too long can really mess with your money.

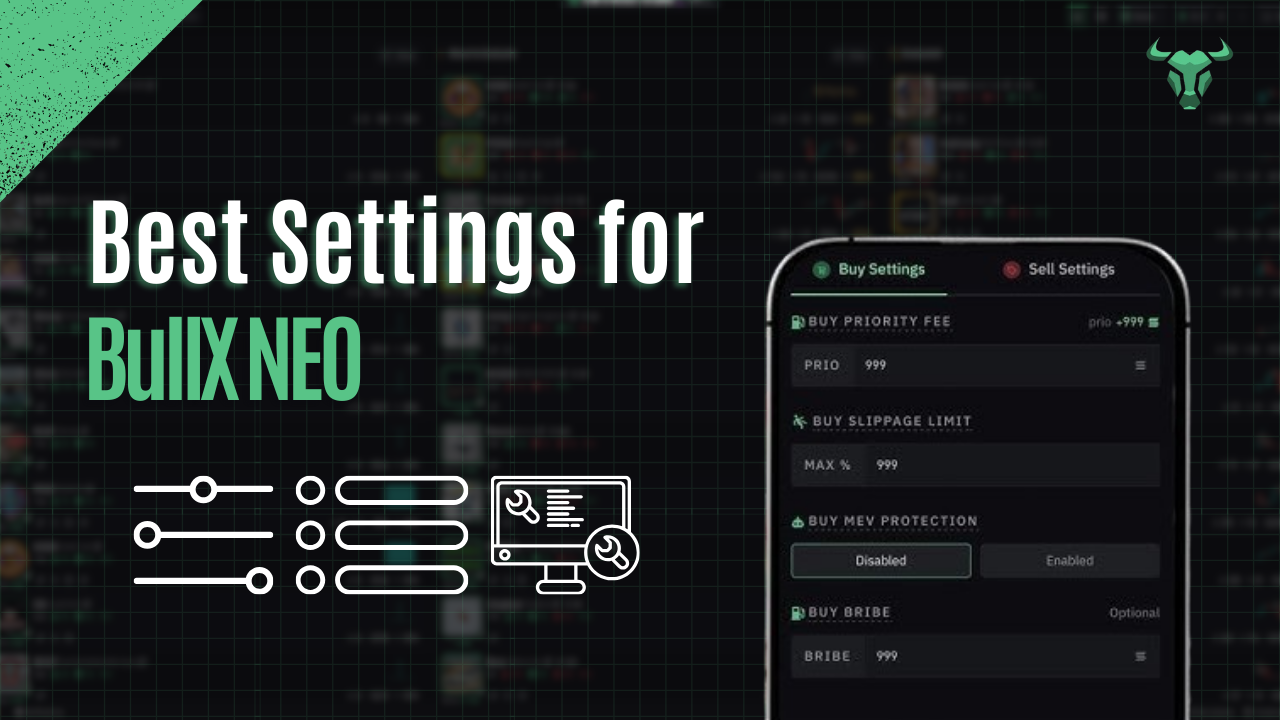

Magnified Losses and Potential for Rapid Depletion

Think of leverage as a double-edged sword. While it can boost your gains, it also magnifies your losses. If the underlying volatility index moves against your position, even a little bit, your ETF's value can drop much faster than you might expect. This means you could lose your entire investment surprisingly quickly. It’s like driving a sports car – you can go fast, but you also need to be really careful with the steering. For instance, if you're using something like BullX NEO for trading, understanding its slippage settings is key to managing rapid price swings, but with ETFs, the risk is built into the structure itself, not just a setting you adjust. You have to be prepared for the possibility of rapid depletion of your capital, especially in choppy markets. This is why many experts suggest these products are not suitable for long-term holding, as noted in discussions about leveraged ETFs in Canada.

The Impact of Contango and Backwardation

Volatility ETFs often use futures contracts to track their underlying indexes. These futures contracts can trade at different prices than the spot price of the index, a phenomenon known as contango or backwardation. Contango happens when futures prices are higher than the spot price, and backwardation is the opposite. For volatility ETFs, contango can be a real drag on performance over time. Because the ETF has to constantly roll its futures contracts forward, it can end up selling contracts at a lower price and buying them at a higher price, eating into returns. This is sometimes called 'roll yield' and it's a silent killer for long-term holders. You might see this effect even when the volatility index itself is moving in a direction that seems favorable. It’s a complex market dynamic that can erode value, making it important to understand the mechanics of volatility tracking.

Suitability for Short-Term Trading Strategies

Given the risks, especially the daily rebalancing and the potential for rapid depletion, leveraged volatility ETFs are generally best suited for short-term trading. They are designed to profit from short-term price movements in volatility. Trying to hold them for extended periods can lead to unexpected results due to the compounding effects of daily rebalancing. This means that the ETF’s performance over periods longer than a day might not be a simple multiple of the underlying index’s performance. You might be looking to capitalize on market swings, similar to how some traders use tools like BullX NEO to snip memecoins early, but the ETF structure introduces its own unique set of challenges. You need a clear exit strategy and a good understanding of when to get in and out of the market. They are not a way to get rich quick over months or years; they are tools for tactical, short-term plays. As one source puts it, these products are not designed for buy-and-hold strategies.

The daily rebalancing is a key feature that makes these ETFs behave differently over longer time horizons compared to simple leveraged products. It's a constant reset that can lead to performance decay, especially in volatile or sideways markets. You're essentially betting on daily directional moves, and the compounding effect of those daily moves, amplified by leverage, can lead to significant deviations from the expected long-term performance of the underlying index.

Strategies Employing Leveraged Volatility ETFs

So, you're looking at leveraged volatility ETFs and wondering how you might actually use them. They aren't exactly your everyday buy-and-hold investments, but they can fit into certain trading plans. Think of them as tools for specific situations, not for your retirement fund.

Hedging Portfolio Risk

One way people use these ETFs is to protect their main investments. If you're worried about a big market drop, you might buy a volatility ETF. The idea is that when the market goes down, volatility often goes up. A leveraged volatility ETF could potentially make more money during these downturns, helping to offset losses in your other holdings. It's like buying insurance, but with the potential for profit if things get rough. You're essentially betting on uncertainty.

Speculating on Market Swings

This is probably the most common use. You see a lot of chatter about market swings, and maybe you think you can predict when volatility will spike. You could use a leveraged volatility ETF to try and profit from that. For instance, if you anticipate a major economic announcement or a geopolitical event that might shake things up, you might get into a leveraged volatility ETF beforehand. The goal here is to capture those rapid price movements. It’s a bit like trying to time the market, but focused specifically on the fear or uncertainty index. For those looking to capitalize on short-term market movements, tools like the bullx neo trading bot can help manage these speculative trades, especially in the crypto space, by automating entry and exit points based on your strategy.

Utilizing Volatility as an Asset Class

Some traders view volatility itself as something you can invest in, almost like stocks or bonds. They might use leveraged volatility ETFs to gain exposure to this

Choosing the Right Leveraged Volatility ETF

So, you're looking at leveraged volatility ETFs and wondering how to pick the right one? It’s not as simple as just grabbing the first one you see. You really need to do your homework.

Assessing Underlying Volatility Indices

First off, what is this ETF actually tracking? Most of these products are tied to volatility indexes, like the Cboe Volatility Index (VIX). You need to understand how that index works, what drives it, and what its historical performance looks like. Some ETFs might track futures contracts on the VIX, which adds another layer of complexity. Knowing the index is step one to understanding the ETF's behavior. You can find information on these indices through various financial news sites or directly from the index providers.

Evaluating Expense Ratios and Tracking Differences

Next up, let's talk costs. Leveraged ETFs, including those focused on volatility, tend to be more expensive than your average ETF. You'll see expense ratios that are higher, sometimes significantly so. For instance, an expense ratio around 0.95% isn't uncommon for these types of products. Also, keep an eye on the tracking difference. This is the difference between the ETF's performance and the performance of the index it's supposed to track. Due to the daily rebalancing and the costs involved, there can be a noticeable gap, especially over longer periods.

Understanding the ETF's Specific Leverage Ratio

This is pretty straightforward but super important. What's the leverage? Is it 2x, 3x, or something else? This ratio tells you how much the ETF aims to amplify the daily returns of its underlying index. A 2x leveraged ETF, for example, aims to deliver twice the daily performance. Remember, this leverage applies to daily movements and can lead to magnified losses just as easily as magnified gains. If you're looking for tools to help you manage and track your trades, especially in crypto, a tool like the BullX Wallet Tracker can be useful. For those focused on high-speed trading and getting an edge, BullX NEO Hyper Vision offers features like a speed boost and real-time data. Accessing this kind of information can be made easier with tools like the bullx neo telegram bot, which can keep you updated on market movements.

These ETFs are designed for short-term trading. Their daily reset mechanism means their long-term performance can look very different from the underlying index, often diverging significantly. You're really looking at a day-trading tool here, not something to buy and hold for years.

When you're picking one, think about your own trading style and risk tolerance. Are you looking to hedge, speculate, or treat volatility as its own asset class? Your goal will influence which ETF is the best fit. For example, if you're trying to profit from expected market swings, you might look at ETFs that track volatility indexes directly. It's a complex area, and these products are generally better suited for experienced investors who understand their mechanics.

The Appeal of Leveraged Volatility ETFs for Traders

So, why are traders drawn to leveraged volatility ETFs? Well, it often comes down to wanting to make bigger moves in the market, especially when things are moving fast. These products can really amplify your potential gains, but you've got to remember they can just as easily amplify your losses. It’s like using a magnifying glass on market swings – you see the ups and downs much more clearly, and the effects are magnified.

Seeking Amplified Returns

If you're looking to get more bang for your buck, these ETFs might seem attractive. They aim to deliver multiples of the daily performance of a volatility index. For instance, a 2x leveraged ETF tries to double the daily return. This means if the volatility index goes up 1% in a day, a 2x ETF could theoretically go up 2%. However, this amplification works both ways. If the index drops 1%, the ETF could drop 2%. It’s a way to potentially boost your returns when you're right about the direction of volatility.

Capitalizing on Short-Term Market Movements

Volatility, by its nature, can change quickly. Leveraged volatility ETFs are designed to track these short-term changes. This makes them appealing for traders who want to bet on immediate market reactions or anticipate upcoming price swings. For example, if you expect a major economic announcement to cause a spike in market uncertainty, you might consider a product like BullX NEO, which is built to react to these kinds of shifts. The key here is timing and a clear view of immediate market dynamics. You're not typically holding these for the long haul; it's more about capturing quick opportunities. This is why many traders use them for day trading strategies, aiming to profit from intraday price action. You can explore different trading strategies for these instruments at popular leveraged ETFs.

Accessing Volatility Instruments

Volatility itself can be seen as an asset, and these ETFs provide a straightforward way to get exposure to it. Instead of trying to trade complex volatility derivatives directly, which can be quite involved, you can buy shares of a leveraged volatility ETF. This simplifies the process, making volatility trading more accessible. It’s a way to participate in the volatility market without needing to understand all the intricate details of futures contracts or options. You can also look into how trading bots might help execute strategies related to these movements, as discussed in building and deploying a bot. It’s about having a tool that lets you express a view on how uncertain or stable the market might be, with the added punch of leverage.

Leveraged volatility ETFs can be a thrilling choice for traders looking to amplify their market bets. These tools let you aim for bigger gains by using borrowed money to increase your exposure to price swings. Think of it like using a magnifying glass to see smaller market movements become larger opportunities. They're not for everyone, as they also come with bigger risks. Want to learn more about how these can fit into your trading strategy? Visit our website to explore the exciting world of leveraged ETFs and discover how they might help you reach your trading goals.

So, What's the Takeaway?

So, you've looked at leveraged volatility ETFs. They can be pretty wild, right? They aim to give you bigger moves when the market swings, but that also means bigger losses when things go the other way. Think of them like a shortcut that can get you there faster, but also has more bumps in the road. If you're thinking about using them, make sure you really get how they work and what risks you're signing up for. It's not for everyone, and it's definitely not a set-it-and-forget-it kind of investment. Do your homework first.

Frequently Asked Questions

What exactly is a leveraged volatility ETF?

Think of a leveraged volatility ETF as a way to bet on how much the market is going to jump around. It uses borrowed money to try and make your potential gains, or losses, much bigger. It's like using a magnifying glass for market swings. These ETFs usually track something called a volatility index, which measures expected market ups and downs.

Can you hold these ETFs for a long time?

These ETFs are designed for short-term trading. Because they use leverage and reset daily, holding them for a long time can be really risky. The daily changes can add up in unexpected ways, often hurting your returns over longer periods. It's best to think of them as tools for quick trades, not long-term investments.

Are these ETFs dangerous to use?

Yes, they can be super risky! Because of the leverage, if the market moves against you, you could lose your money very quickly. The value can drop to zero much faster than with regular investments. You need to be prepared for the possibility of big losses.

How do people use these ETFs?

You can use them to try and protect your main investments if you think the market might get choppy. Or, you might use them if you believe market swings are going to get bigger, hoping to make a profit from that movement. Some people even treat volatility itself as something to trade.

What should you look for when picking one?

You'll want to look at what specific market swings the ETF is tracking. Also, check how much it costs to own (the expense ratio) and how closely it follows its target index. Most importantly, know how much leverage it uses – is it 2x, 3x, or something else? This tells you how much your gains or losses could be multiplied.

Why do traders like these ETFs?

Traders like them because they can potentially make big profits quickly if they guess the market's movements correctly. They offer a way to quickly jump on short-term opportunities when the market is moving a lot. It's a way to get more bang for your buck, but with more risk.

More BullX NEO Guides: