How to Use a Day Trading Robot

Thinking about using a day trading robot to help with your crypto trades?

It's like having a little assistant that can watch the market for you and make trades based on rules you set.

We'll walk you through how to get one set up and start using it, keeping things simple so you can focus on making smart moves.

Key Takeaways

- A day trading robot automates your crypto trades, executing them based on predefined strategies.

- Setting up involves connecting your trading accounts and funding your wallet, often directly through platforms like Telegram.

- Familiarize yourself with the robot's dashboard and analytics to understand its actions and performance.

- Learn to initiate trades, use features like sniper buys, and set specific orders for better control.

- Prioritize security by protecting your digital assets and understanding the robot's safety features.

Understanding Your Day Trading Robot

So, you're looking to get a day trading robot, huh?

It's a big step, and it's smart to know what you're getting into.

Think of a trading robot, like BullX NEO, as your automated partner in the fast-paced world of crypto.

It's designed to help you make trades faster and, hopefully, smarter. These bots work by following a set of rules, often using algorithms, to buy and sell assets without you having to constantly watch the charts.

This means you can potentially catch opportunities even when you're not actively trading.

It's all about automating the process, which can be a game-changer, especially in volatile markets.

Core Functionality of a Day Trading Robot

At its heart, a day trading robot automates the buying and selling of financial instruments.

It executes trades based on predefined criteria, which could be anything from price movements to specific market indicators.

For instance, a bot might be programmed to buy a token if its price increases by 5% within an hour or sell if it drops by 3%.

This algorithmic approach means trades happen much quicker than a human could manage, which is key for day trading where timing is everything.

BullX NEO, for example, operates entirely through Telegram, allowing for rapid execution of trades right from your phone.

This kind of automation is what makes day trading bots so appealing to many.

Key Features to Look For

When you're picking out a trading bot, there are a few things you'll want to keep an eye on.

First, consider the speed of execution.

In day trading, milliseconds can matter, so a bot that can react instantly is a big plus.

Look for features like real-time analytics and charting directly within the bot's interface, as this helps you stay informed.

BullX NEO, for instance, offers lightning-fast execution and provides real-time token discovery and charting within Telegram.

Another important feature is the ability to set custom parameters, like stop-loss orders or take-profit targets, to manage your risk.

Security is also paramount; you want a bot that has built-in safety checks, like rug pull detection, to protect your funds.

Benefits of Automated Trading

Automated trading, especially with a tool like BullX NEO, brings several advantages to the table.

One of the biggest is the removal of emotional decision-making.

Fear and greed can often lead traders to make poor choices, but a bot sticks to its programming, regardless of market sentiment.

This consistency can lead to more disciplined trading.

Another benefit is the ability to trade 24/7.

Markets don't sleep, and a bot can continue to operate and identify opportunities even when you're offline or asleep.

This constant market participation can increase your potential for profit.

Plus, it saves you a ton of time; instead of staring at screens, you can let the bot do the heavy lifting, freeing you up for other activities.

It's a way to participate in the market more efficiently, and many find it helps them stick to their trading plans more effectively.

The efficiency gained from automated trading can be significant, allowing traders to focus on strategy development and risk management rather than the manual execution of every single trade. This shift in focus can lead to better overall performance and a more sustainable trading approach.

Here's a quick look at what makes a good bot:

- Execution Speed: How fast can it buy and sell?

- User Interface: Is it easy to use, especially on mobile?

- Security Features: Does it protect against common scams?

- Customization: Can you set your own rules and parameters?

- Analytics: Does it provide real-time market data?

When you're exploring options, checking out platforms like BullX NEO can give you a good sense of what modern trading bots are capable of.

They're built to help you navigate the complexities of the crypto market with more ease and speed.

You can find more about how trading bots operate by looking into resources that explain how trading bots operate.

Setting Up Your Day Trading Robot

Getting your day trading robot, like BullX NEO, up and running is pretty straightforward.

You don't need to be a coding wizard or anything.

It’s mostly about connecting your accounts and telling the bot what you want it to do.

Think of it like setting up a new app on your phone, but for trading.

Connecting Your Trading Accounts

First things first, you need to link your crypto wallet to the trading bot.

BullX NEO, for instance, works directly through Telegram, so you’ll connect wallets like Phantom, Solflare, or TronLink right within the chat interface.

This connection is how the bot accesses your funds to make trades.

It’s a secure process, usually involving a simple authorization step.

No need to download extra software or browser extensions; it all happens within the familiar Telegram environment.

This makes it super easy to manage your trades on the go.

Configuring Initial Parameters

Once your wallet is linked, you’ll set up some basic settings.

This might include things like your preferred trading pairs, initial investment amounts, or risk tolerance levels.

For example, you might tell BullX NEO the maximum amount you’re comfortable spending on a single trade or the minimum liquidity a token needs to have before it considers trading it.

These initial settings help the bot understand your trading style and risk appetite.

You can always tweak these later as you get more comfortable.

Funding Your Trading Wallet

Finally, you need to put some funds into the wallet you’ve connected to the bot.

If you’re using BullX NEO, you’ll deposit cryptocurrencies like SOL or TRX directly into your linked wallet.

There’s typically no KYC (Know Your Customer) process required for this, which keeps things fast and private.

Just send your crypto to your wallet address, and once it’s confirmed on the blockchain, you’re ready to start trading.

It’s important to only fund your trading wallet with what you’re prepared to trade with, keeping your main holdings separate for security.

This is a key step before you can begin executing any trades with your new bot, allowing for continuous market engagement trading bots automate cryptocurrency trading.

Navigating the Day Trading Robot Interface

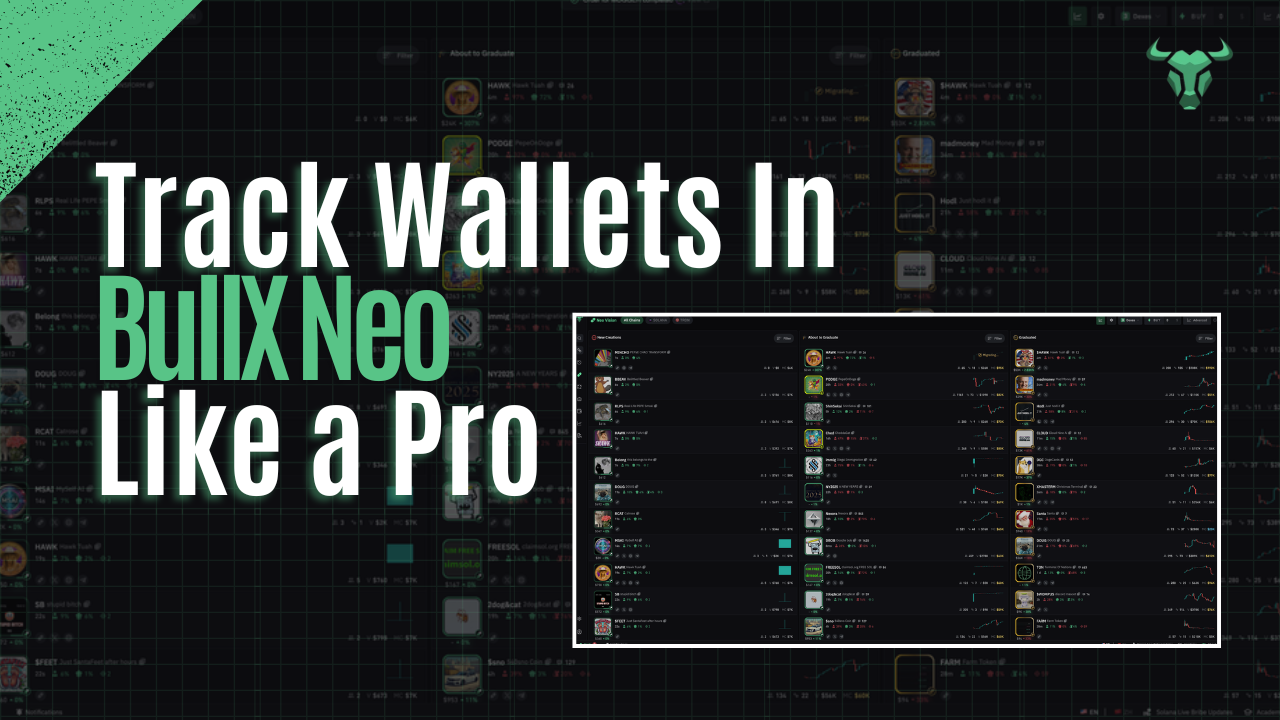

Once you've got your trading accounts linked and your initial parameters set, it's time to get familiar with the BullX NEO interface.

Think of this as your command center.

It’s where you’ll see everything that’s happening and where you’ll make your moves.

Exploring the Dashboard

The main dashboard is your go-to spot.

It gives you a quick overview of your trading activity, your current portfolio status, and any active trades.

You can see key metrics at a glance, helping you stay on top of your game.

It’s designed to be clean and straightforward, so you’re not wading through a bunch of confusing data right away.

You can also switch between different wallets if you're managing more than one, which is a nice touch for keeping things organized.

Understanding Real-Time Analytics

This is where BullX NEO really shines.

You’ll find detailed analytics that update live.

This includes things like trending tokens, trading volumes, and even information on whale movements.

Being able to see this data as it happens is key to making quick decisions.

You can filter opportunities based on various criteria, like liquidity or market cap, to find the trades that fit your strategy.

It’s like having a market scanner built right in.

Accessing Trading History

Need to review past trades?

The trading history section keeps a record of all your executed orders.

You can look back at specific trades, see the outcomes, and analyze your performance over time.

This is super helpful for understanding what worked and what didn’t, so you can tweak your approach.

It’s all laid out clearly, making it easy to track your progress and learn from your trading journey.

You can find out more about how these systems work in this guide to algorithmic trading systems.

The interface is built to be intuitive, especially if you're using it through Telegram. This means you don't need to install anything extra, and you can manage your trades right from your phone. It’s all about making the process as smooth as possible, whether you're a seasoned trader or just starting out with bots like these, which are often compared to Forex trading bots in terms of automation.

Executing Trades with Your Day Trading Robot

Once you've got your trading bot set up, it's time to actually make some trades.

This is where the automation really kicks in, and with a tool like BullX NEO, it's designed to be pretty straightforward.

You're not just hitting a 'buy' button randomly; you're using specific functions to execute your strategy.

Initiating Automated Trades

Most trading bots, including BullX NEO, allow you to set up automated trading strategies.

This means the bot watches the market for you and executes trades based on the rules you've programmed.

You might set it to buy a token when its price crosses a certain moving average or sell when it hits a profit target.

The goal is to let the bot do the heavy lifting while you focus on refining your strategy.

It's like having a tireless assistant who never sleeps.

You can find out more about how these bots work by looking into how trading bots function.

Utilizing Sniper Buys

For those looking to get in on new token launches or quick pumps, a 'sniper buy' feature is pretty handy.

This allows the bot to execute a buy order almost instantly when a token becomes available or hits a specific price point, often before others can react.

BullX NEO, for example, is built for speed on the Solana blockchain, which is ideal for this kind of rapid execution.

It’s all about getting your order in at the best possible moment.

Setting Advanced Limit Orders

Beyond simple buy and sell orders, many bots let you set more complex conditions.

This could include limit orders that only execute when a specific price is met, or even trailing stop-loss orders that adjust as the price moves in your favor.

These advanced features help you manage risk and capture profits more effectively.

For instance, you might set a limit order to buy a token if it dips to a certain level, but only if it’s still above a critical support line.

This kind of precision is what separates basic trading from more strategic approaches, and it’s something you can explore with tools like BullX NEO's features.

Leveraging Advanced Day Trading Robot Features

Once you've got the basics down, it's time to see what else your day trading robot can do.

Think of these as the power-ups that can really make a difference in your trading.

BullX NEO, for instance, packs a lot of these advanced features right into Telegram, making them pretty accessible.

Copy Trading Top Wallets

This is a pretty neat feature.

Basically, you can link your account to follow what experienced traders are doing.

It’s like having a seasoned pro make trades for you, automatically.

You can pick traders based on their performance history and let the bot mirror their actions.

It’s a good way to learn and potentially profit without having to do all the research yourself.

Just remember to spread your investments across a few different traders to manage risk.

You can check out how this works in more detail on copy trading platforms.

Real-Time Security Monitoring

Keeping your assets safe is a big deal, right?

Advanced bots often include features that watch over your wallets and trades in real-time.

This can include things like alerts for unusual activity or checks for potential scams, like rug pulls.

BullX NEO, for example, offers real-time security audits and rug checks, giving you an extra layer of protection. It’s about having peace of mind while you trade.

Multi-Wallet Management

If you’re managing funds across different accounts or blockchains, this feature is a lifesaver.

It lets you connect and manage multiple wallets from one place within the bot’s interface.

This means you can switch between wallets easily, move funds, and execute trades without a hassle.

For example, BullX NEO allows for multi-wallet and account switching, simplifying how you handle different crypto assets and trading strategies.

It makes keeping track of everything much simpler.

Optimizing Your Day Trading Robot Strategy

So, you've got your day trading robot, like BullX NEO, up and running.

That's great, but just having it isn't enough.

To really make it work for you, you need to tweak its settings and how you use it.

It’s all about making the bot smarter and more aligned with what you want to achieve in the market.

Discovering Trending Tokens

One of the best ways to get ahead is by finding tokens that are starting to gain traction before everyone else does.

BullX NEO has a neat feature that shows you what's hot right now, pulling data from places like Pump.fun and Solana trending charts.

This helps you spot opportunities early.

Think of it as having a radar for new potential winners.

Filtering Trading Opportunities

Not every trending token is a good buy, though.

You'll want to filter these opportunities based on things like trading volume, how many people hold the token, and how much money is readily available to trade (liquidity).

BullX NEO lets you set these filters so you're not just chasing every shiny new coin.

It helps you focus on the ones that actually have a chance.

Adjusting Safety Settings

This is super important.

You don't want your bot to take on too much risk, especially when you're just starting out or when the market is a bit wild.

BullX NEO includes automated safety settings that can help prevent common mistakes.

You can adjust things like how much of your wallet to use for a single trade or set stop-loss levels.

It’s wise to start with conservative settings and gradually increase them as you get more comfortable and see how the bot performs.

Remember, protecting your capital is the first step to long-term success in trading.

You can explore different automated trading strategies to see what works best for your risk tolerance here.

Over-optimization can be a trap. While tweaking settings is good, be wary of making the bot too specific to past data. Real-world trading conditions change, and a strategy that worked perfectly in backtests might not perform as well live.

Always monitor your bot's performance in real-time and be prepared to make adjustments based on current market behavior, not just historical patterns.

This is a key part of optimizing your robot.

Here’s a quick look at how you might adjust some settings:

- Initial Investment Per Trade: Start small, maybe 1-5% of your total trading capital.

- Take Profit Target: Set a realistic goal, like 5-10% profit before the bot exits.

- Stop Loss: Define a maximum loss you're willing to accept, perhaps 2-3%.

- Slippage Tolerance: Adjust this based on market volatility; higher volatility might need more slippage room.

By carefully adjusting these parameters, you can tailor your trading bot's behavior to match your personal trading style and risk appetite.

It’s about finding that sweet spot where the bot is active enough to catch opportunities but cautious enough to protect your funds.

You can build a trading strategy based on entry points, exit points, and position sizing here.

Day Trading Robot Security and Best Practices

Keeping your digital assets safe is a big deal when you're day trading.

It's not just about making profits; it's also about protecting what you have.

Think of your trading bot like a digital vault – you want to make sure it's locked down tight.

Protecting Your Digital Assets

When you're using a tool like BullX NEO, which operates through Telegram, you're already cutting down on some risks associated with browser extensions or desktop apps.

However, you still need to be smart about how you handle your private keys and wallet connections.

Always double-check the official BullX NEO Telegram channel for links and updates to avoid phishing attempts.

It's also a good idea to use a dedicated wallet for your trading activities, separate from your main crypto holdings.

This way, if something unexpected happens, your entire portfolio isn't exposed.

Understanding Rug Checks

Many trading bots, including BullX NEO, offer built-in rug pull detection.

This is a really useful feature. A rug pull is when the creators of a new token suddenly disappear with investors' money.

The bot's rug check feature analyzes a token's contract and liquidity before you buy, flagging potential risks.

It's not a foolproof guarantee, but it's a strong indicator that can help you avoid scams.

Always pay attention to these warnings.

Maintaining Secure Wallet Connections

Connecting your wallet to any trading platform requires trust.

With BullX NEO, you'll typically connect wallets like Phantom or Solflare.

Make sure you're connecting through the legitimate bot interface.

Never share your seed phrase or private keys with anyone, not even the bot's support.

The platform should only ask you to connect your wallet, not to input sensitive recovery information.

Keeping your wallet software itself updated is also part of maintaining a secure connection.

You can find more information on securing your assets at staying current with security.

Here’s a quick checklist for secure wallet connections:

- Verify the bot's official Telegram handle.

- Never share your seed phrase or private keys.

- Use a dedicated trading wallet.

- Keep your wallet software updated.

- Review the bot's security features, like rug checks.

Keeping your day trading bot safe is super important.

Think of it like locking your bike – you want to make sure no one unauthorized can get to your money.

Using strong passwords and being careful about where you click are simple steps that make a big difference.

Want to learn more about keeping your trading tools secure and using them the best way possible?

Visit our website for easy-to-follow tips and guides.

Conclusion

So, you've learned about how these trading bots work and how to get started with something like BullX NEO.

It's pretty neat how you can manage trades right from your phone using Telegram.

Remember, though, this isn't a magic money-making machine.

You still need to do your homework and understand the risks involved in crypto trading.

Start small, learn the ropes, and see if this kind of automated trading fits your style.

Good luck out there!

Frequently Asked Questions

What exactly does a day trading robot do?

Think of your trading bot as a super-fast helper that watches the market for you. It uses special instructions you give it to buy and sell digital coins automatically. This means you don't have to stare at your screen all day; the bot does the heavy lifting based on the rules you set.

How do I get my trading bot ready to use?

You'll want to connect your crypto wallet, like Phantom or Solflare, to the bot. Then, you'll add some funds (like SOL coins) to your trading account. After that, you can start telling the bot what to do, like which coins to look for or how much to spend.

What will I see on the bot's main screen?

The main screen, or dashboard, shows you everything that's happening in real-time. You can see your current trades, how much money you have, and charts that help you understand the market. It's like the control center for your trading.

How does the bot actually trade coins?

You can tell the bot to automatically buy coins when they hit a certain price, or even try to buy them the moment they become available – that's like a 'sniper buy'. You can also set up 'limit orders' which are like saying, 'Buy this coin, but only if the price is this low.'

What are some of the advanced things my bot can do?

Some bots let you copy what other successful traders are doing, which is called 'copy trading'. They also keep an eye out for risky scams ('rug checks') and make sure your digital money is safe. Plus, you can often manage multiple crypto wallets at once.

How can I make my bot trade smarter?

You can help your bot make better choices by looking for coins that are becoming popular or have lots of people trading them. You can also adjust the bot's settings to be safer, like setting limits on how much you're willing to spend or lose on a single trade.

More BullX NEO Guides: