How to Avoid Rug Pulls with BullX NEO Vision

BullX NEO Vision

The cryptocurrency market offers countless opportunities, but it also comes with risks: rug pulls being one of the most common scams. A rug pull occurs when developers create a token, build hype around it, then suddenly drain the liquidity and abandon the project, leaving investors with worthless assets. BullX NEO has provided amazing features to help assist you.

For traders, the key to success isn’t just finding promising tokens but also avoiding scam projects before they collapse. This is where BullX NEO Vision comes in.

BullX NEO Vision is an advanced real-time analytics tool designed to detect suspicious tokens before traders invest in them. It scans on-chain data, identifies red flags like developer wallet movements, centralized holder distribution, and artificial price manipulation, and presents this data in an easy-to-read format.

In this guide, we’ll break down how BullX NEO Trading Bot helps traders avoid rug pulls, highlight its key scam detection filters, and provide a step-by-step tutorial on how to use it effectively. We’ll also share a real-world example of how BullX NEO Vision saved traders from a scam token.

What is BullX NEO Vision and How Does It Work?

NEO Vision is an advanced analytics tool built into BullX NEO, designed to help traders identify potential scam tokens before they invest. Unlike traditional market research, which requires hours of manual investigation, NEO Vision scans and analyzes tokens in real-time, highlighting high-risk projects with clear visual indicators.

Here’s how NEO Vision works to detect rug pulls and protect traders:

1. Scans Wallet Distribution to Spot Risky Tokenomics

One of the biggest warning signs of a potential rug pull is centralized token ownership. If a single wallet, or a small group of wallets, holds a majority of the supply, the token is at high risk of a dump.

- What to look for: If a developer or a few insiders control more than 50% of the total supply, they can sell their holdings suddenly, crashing the price;

- How BullX NEO Vision helps: It provides a holder distribution chart, visually displaying whether a token is decentralized or controlled by a few wallets.

💡 Example: A trader scans a new token and sees that 80% of the supply is held by one wallet, this is a clear rug pull risk, and they can avoid investing.

2. Tracks Developer Wallet Activity to Detect Exit Scams

A common rug pull tactic is when developers create hype, pump the price, and then sell off all their holdings or remove liquidity.

- What to look for: Frequent developer wallet sales or large amounts of liquidity being pulled;

- How BullX NEO Vision helps: It monitors dev wallet activity in real time, providing alerts when large transfers or suspicious withdrawals occur.

💡 Example: A trader sees that the developer wallet has been making small, gradual sales over the past 24 hours. This pattern suggests an ongoing slow rug, and they exit before the major sell-off.

3. Identifies Bundled Buys and Fake Pumping

Scammers often manipulate price action by using multiple wallets to buy tokens at the same time, making it appear as though the token is gaining organic demand.

- What to look for: If a cluster of wallets buys in sync at the same intervals, it indicates trading bot activity or a coordinated fake pump;

- How NEO Vision helps: It detects and highlights these bundled buy patterns, helping traders differentiate between real and fake demand.

💡 Example: A trader checks a trending token and sees that the same few wallets are buying every 30 seconds in equal amounts. This signals market manipulation, and they decide to stay away.

4. Monitors Liquidity Health to Prevent Instant Rugs

One of the fastest ways scammers execute rug pulls is by removing liquidity suddenly, making it impossible for traders to sell their tokens.

- What to look for: A token should have locked liquidity or liquidity managed by decentralized protocols;

- How NEO Vision helps: It checks whether the liquidity is locked or if the developer has control over it, preventing traders from falling into liquidity removal scams.

💡 Example: A trader sees that a newly launched token has all its liquidity held by a developer wallet instead of a locked pool. This is a major red flag, and they avoid buying.

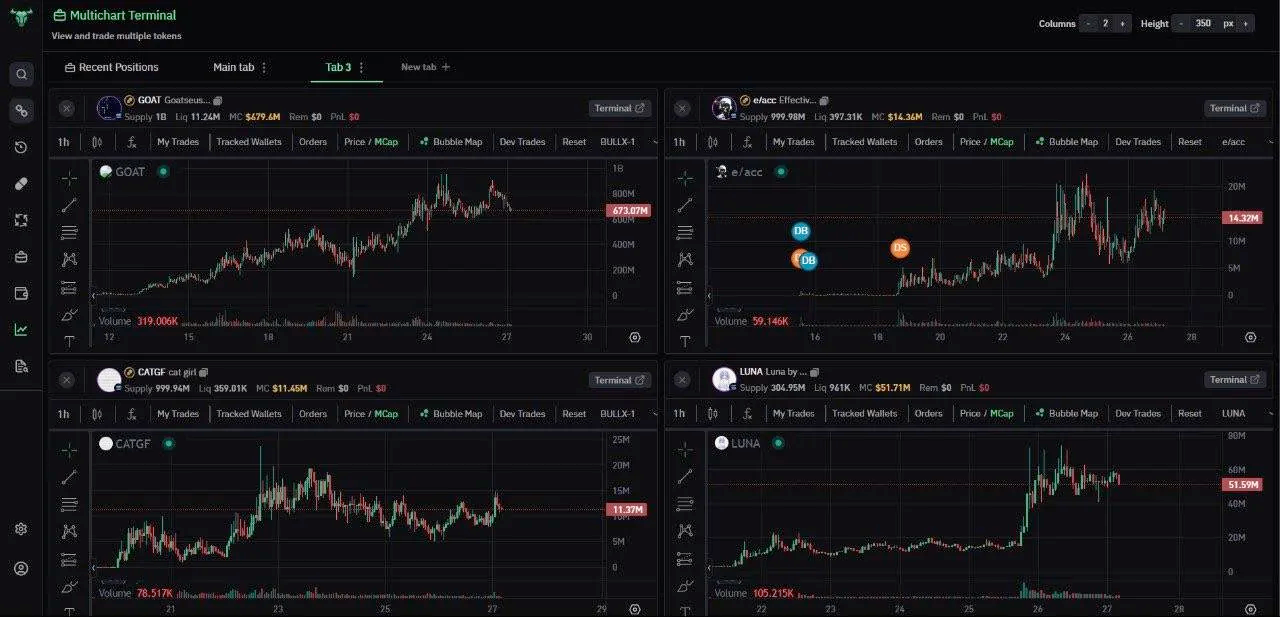

5. Displays Real-Time Token Analytics for Quick Decisions

Instead of spending hours manually researching a token, BullX NEO Solana Bot provides all these risk indicators in a clear, easy-to-read format.

- A risk score based on wallet activity, holder concentration, and trading patterns;

- A real-time transaction feed showing developer movements and suspicious transactions;

- Interactive charts that help traders visualize token health before making a decision.

💡 Example: A trader is about to buy into a token, but after scanning it with BullX NEO Vision, they see multiple high-risk warnings. They decide to avoid the trade, saving themselves from a likely scam.

Key Filters That Help Detect Rug Pulls

NEO Vision uses powerful filters and real-time data analysis to help traders detect potential scams before investing. By analyzing wallet activity, holder distribution, buy/sell patterns, and liquidity conditions, it provides clear insights into a token’s legitimacy. Here’s a breakdown of the most important filters that traders should use to spot rug pulls and avoid losing funds.

Holder Distribution: Spotting Centralized Ownership

A token with healthy distribution means that many different wallets hold small portions of the supply. However, if a single wallet, or a small group, controls a large percentage, it puts the token at high risk of manipulation or a sudden dump.

Red Flags:

- 1-3 wallets holding 50%+ of the total supply;

- Airdrop wallets with large allocations that haven’t yet sold (potential future dump risk);

- Developer wallets that control significant supply.

✅ How NEO Vision Helps:

- Displays a Holder Distribution Chart that visually highlights large token concentrations;

- Provides instant alerts when a small number of wallets control an excessive amount of the supply.

Developer Wallet Activity: Tracking Insider Behavior

One of the most common rug pull tactics is when developers secretly sell off their holdings, leaving investors stuck with worthless tokens.

Red Flags:

- The developer wallet is actively selling into buy pressure;

- The dev wallet makes frequent transactions, moving tokens across multiple wallets (to hide sell-offs);

- Large wallet transfers to centralized exchanges (CEXs)—a sign of preparing for a big exit.

✅ How NEO Vision Helps:

- Tracks developer wallets in real-time, displaying their buys, sells, and transfers;

- Flags suspicious sell patterns, giving traders time to exit before a rug pull occurs.

Bundled Buys & Fake Pumping: Detecting Market Manipulation

Some scam tokens create artificial volume by using trading bots or insider wallets to buy simultaneously, making it appear as if a token is gaining organic momentum.

Red Flags:

- Multiple wallets buying the same amount at the same time (trading bot behavior);

- Large buy orders from wallets that never sell, meant to fake demand;

- Consistent price spikes with no real liquidity increase (a sign of a pump-and-dump scheme).

✅ How BullX NEO Vision Helps:

- Detects bundled buy patterns and flags them as suspicious activity;

- Highlights high-risk trading patterns that could indicate a manipulated pump.

Liquidity Health Check: Preventing Instant Rugs

Liquidity is one of the most important factors when assessing a token’s risk. If liquidity is not locked or can be removed by the developer, it puts the token at severe risk of a rug pull.

Red Flags:

- Liquidity is controlled by the dev wallet;

- Low liquidity compared to market cap (e.g., $10 million market cap but only $50,000 liquidity);

- Liquidity can be removed instantly, making selling impossible.

✅ How NEO Vision Helps:

- Checks liquidity lock status and warns if a developer can remove it;

- Analyzes liquidity depth to determine whether the token can handle significant selling pressure.

How to Set Up NEO Vision on BullX NEO (Step-by-Step Guide)

Now that we know how BullX NEO Vision detects scams, let’s walk through how to use it step-by-step so you can analyze tokens before investing.

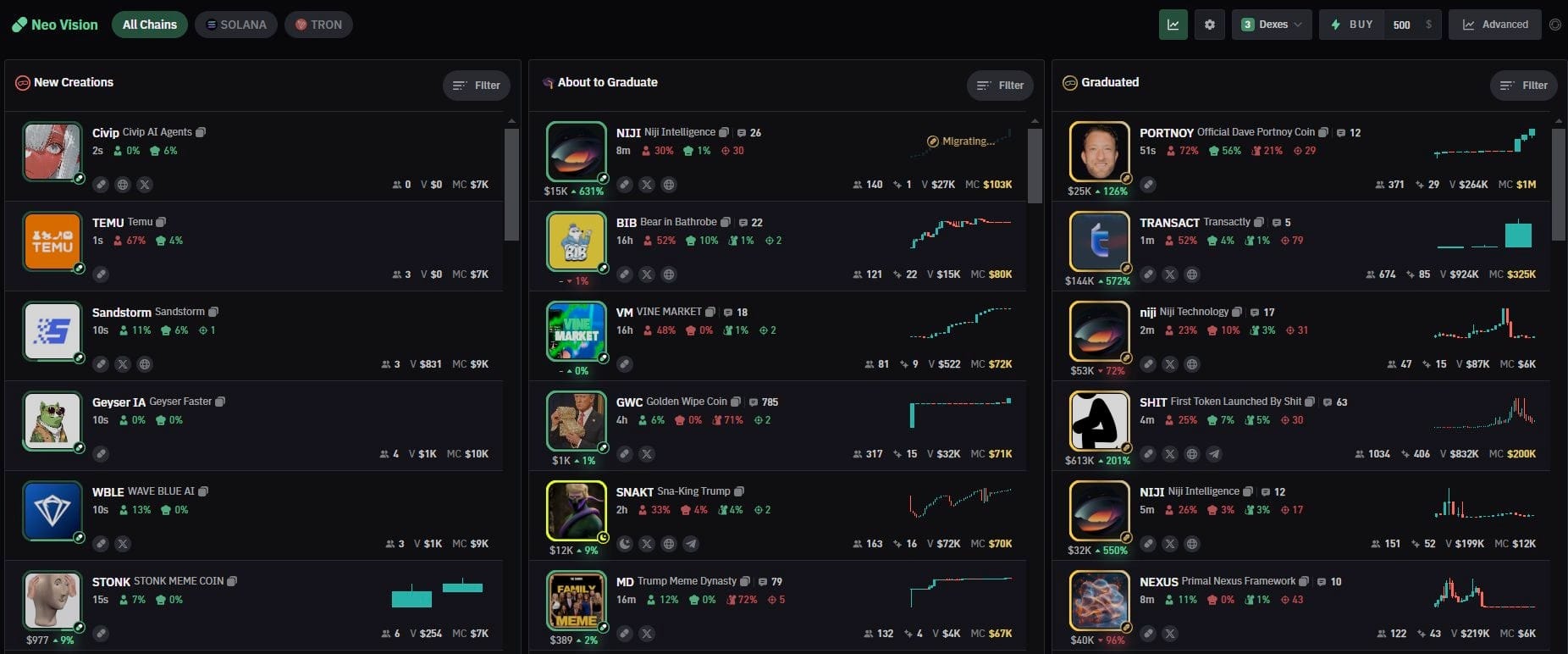

Step 1: Open BullX NEO and Navigate to NEO Vision

- Log in to your BullX NEO account;

- Click on the NEO Vision tab on the main dashboard.

Step 2: Enter the Token Contract Address

- Copy the contract address of the token you want to analyze;

- Paste it into NEO Vision’s search bar and hit enter.

Step 3: Analyze Holder Distribution

- Check the Holder Distribution Chart, if a small number of wallets control most of the supply, be cautious;

- If any single wallet holds 40%+ of the tokens, consider it high risk.

Step 4: Monitor Developer Wallet Activity

- Navigate to the "Developer Wallet" section;

- Look for suspicious transactions, such as frequent sales or transfers to exchanges;

- If the developer wallet has been offloading tokens, be wary of a slow rug pull.

Step 5: Check for Bundled Buys & Fake Pumping

- In the Buy/Sell Activity Tab, check for clusters of purchases happening at the same time, a sign of market manipulation;

- If wallets are repeatedly buying the same amount in intervals, it’s likely a bot-driven pump.

Step 6: Confirm Liquidity Health

- Navigate to the Liquidity Section and check if the liquidity is locked or controlled by a developer wallet;

- If liquidity is removable, consider avoiding the token.

Step 7: Make Your Final Investment Decision

🚨 If BullX NEO Vision detects multiple red flags (high dev control, fake volume, poor liquidity), avoid the token.

✅ If the token has a balanced holder distribution, strong liquidity locks, and no suspicious developer activity, it is safer to trade.

Real-World Example: How NEO Vision Saved Users from a Rug Pull

To demonstrate how powerful NEO Vision is in detecting scam tokens, let’s walk through a real-world example where traders used NEO Vision to avoid a rug pull before it happened.

The Token: "MoonFlare" – A High-Hype Meme Coin

A few weeks ago, a new token called MoonFlare started trending on social media and Telegram groups. The project claimed to be a “next-generation Solana meme coin”, and influencers were hyping it up. It quickly gained momentum, with many traders rushing to buy in.

However, a few experienced traders decided to check it using NEO Vision first and what they found was alarming.

Red Flags Detected by BullX NEO Vision

1. Holder Distribution: A Single Wallet Controlled 70% of the Supply

When traders pasted MoonFlare’s contract address into NEO Vision, the Holder Distribution Chart immediately raised a warning:

- One wallet owned 70% of the total supply;

- The top three wallets controlled 85% of all tokens;

- Only a small number of retail buyers held the remaining 15%.

What this meant: The developer or a single large holder could crash the price at any time by selling all their tokens at once.

2. Developer Wallet Activity: Suspicious Transfers to Exchanges

Next, traders checked the developer wallet history using NEO Vision’s Developer Wallet Tracker. The results were clear:

- The developer had been slowly transferring tokens to a centralized exchange (CEX) over the past 24 hours;

- There were multiple sell orders executed at different intervals, signaling a slow rug pull in progress.

What this meant: The developers were dumping tokens behind the scenes, while promoting the project to lure in new buyers.

3. Fake Pumping Detected: Bundled Buys & Artificial Hype

NEO Vision’s Buy/Sell Activity Tab showed another major red flag:

- Large buy orders were happening at the exact same time, in equal amounts, from different wallets;

- These wallets had no transaction history before MoonFlare, meaning they were likely created solely to inflate buy volume.

What this meant: The team was using bot-driven transactions to create fake hype, making it appear as though the token was organically pumping.

The Outcome: MoonFlare Rug Pulled in Under 48 Hours

Despite the growing hype, savvy traders who used NEO Vision immediately backed away from MoonFlare and warned others. Just two days later, the developers dumped their remaining holdings, completely draining the liquidity pool.

Result?

- Traders who ignored NEO Vision lost nearly 90% of their investments;

- Traders who used BullX NEO Vision avoided a total loss and moved on to safer opportunities.

FAQs: Common Questions About NEO Vision & Rug Pull Prevention

To help traders better understand how to use NEO Vision effectively, here are answers to some of the most frequently asked questions.

1. How accurate is NEO Vision in detecting scams?

NEO Vision uses real-time on-chain data analysis, making it highly accurate at detecting suspicious wallet activity, liquidity risks, and fake trading patterns. While it cannot guarantee 100% accuracy, it provides essential insights that significantly reduce the risk of investing in scam projects.

2. Can I use BullX NEO Vision on every token?

Yes! NEO Vision works on any Solana-based token, providing instant analysis when you enter a contract address.

3. What’s the difference between a soft rug and a hard rug?

- Hard Rug Pull: The developers remove all liquidity instantly, making it impossible for investors to sell;

- Soft Rug Pull: The developers slowly dump their tokens over time, exiting the project while misleading investors.

NEO Vision helps detect both types of rug pulls before they happen.

4. What should I do if I find a suspicious token using NEO Vision?

- Avoid investing: If multiple red flags appear, it’s best to stay away from the token;

- Warn others: If you spot a likely scam, alert trading communities to prevent others from getting caught;

- Report suspicious tokens: Some platforms allow users to flag scam tokens to protect the ecosystem.

Conclusion

Rug pulls and scam tokens continue to plague the crypto market, but with BullX NEO’s NEO Vision, traders can spot red flags early and protect their investments. By using real-time on-chain data, BullX NEO Vision helps traders:

✅ Identify high-risk tokens before investing.

✅ Detect rug pulls using wallet tracking and liquidity analysis.

✅ Avoid market manipulation by spotting fake volume and bot-driven pumps.

Final Tip: Never rely on hype alone, always use NEO Vision to analyze a token before investing. Start Using NEO Vision Today!