Do Day Traders Make Money?

Thinking about jumping into the world of day trading? You've probably heard stories about people making a killing, but also about those who lose their shirts. So, do day traders actually make money? It's a question many ask, and the answer isn't a simple yes or no. It really depends on a lot of factors, from your knowledge and strategy to how you handle the ups and downs. Let's break down what it takes to be a successful day trader and whether it's a path that might work for you.

Key Takeaways

- Day trading involves buying and selling financial instruments within the same trading day, aiming to profit from small price changes. Many day traders don't make money consistently.

- Success as a day trader hinges on understanding market volatility, managing risk carefully, and having enough capital to start and sustain your trading.

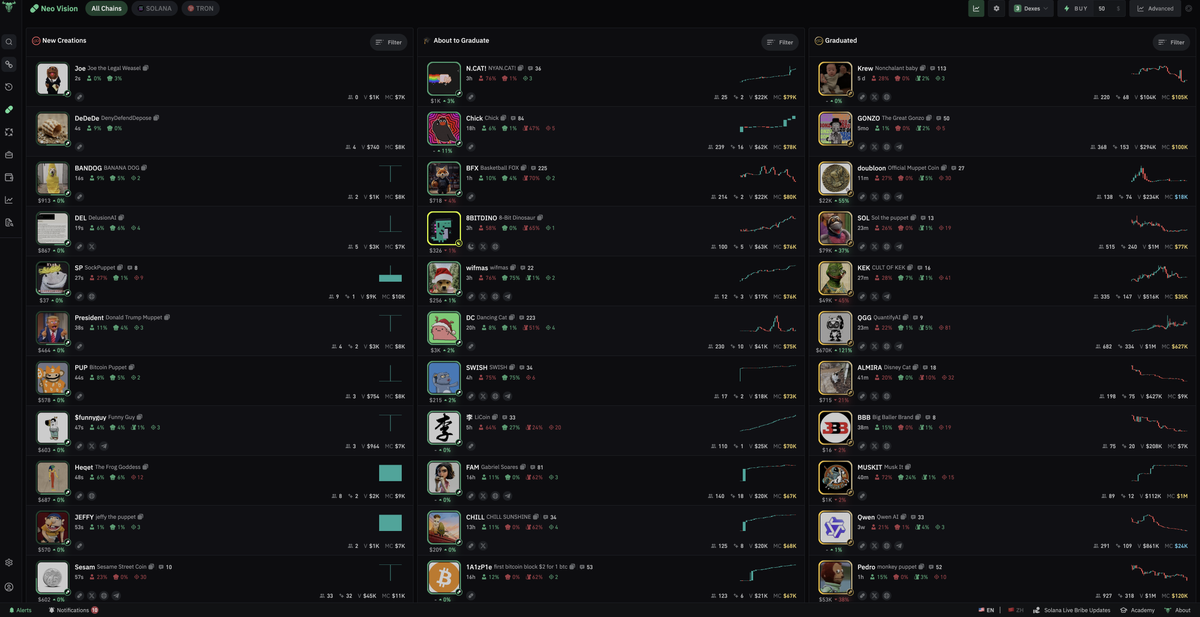

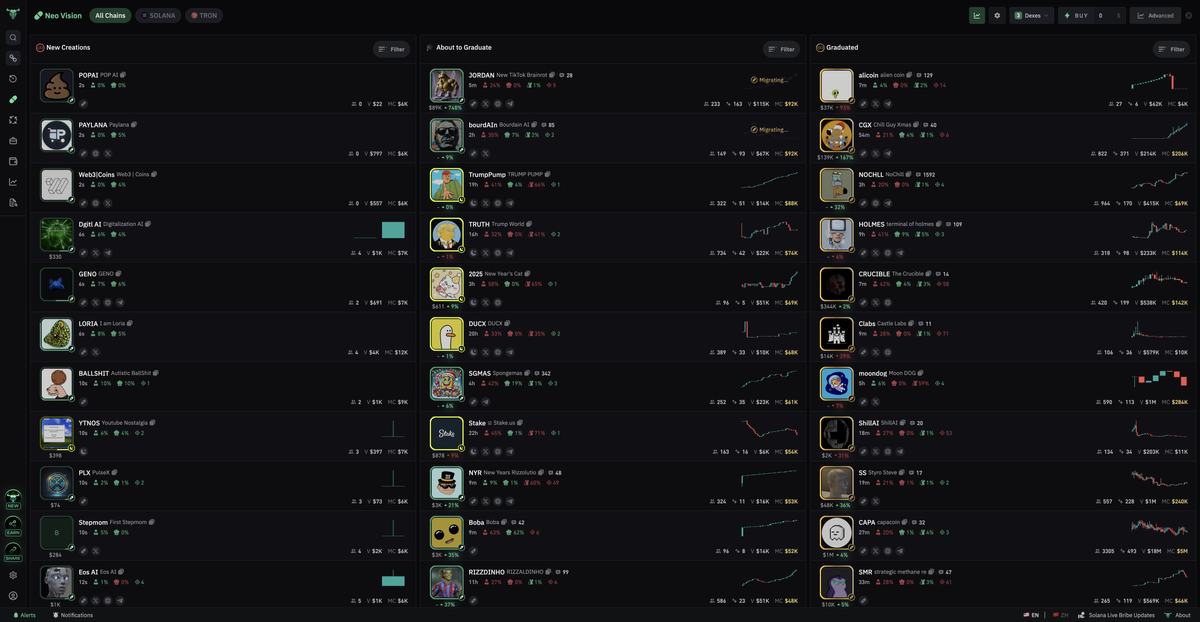

- Trading platforms, real-time data, and tools like trading bots (such as BullX NEO, which offers Telegram integration and multi-chain support) are important for day traders.

- The reality for many day traders is that fees can eat into profits, and common mistakes can lead to significant losses, making long-term viability a challenge.

- Evaluating your trading account growth, understanding the impact of fees, and comparing your results to other investment methods are key to assessing your performance as a day trader.

Understanding The Day Trader's Role

So, you're thinking about becoming a day trader? It's a path many consider, drawn by the idea of profiting from quick market moves. But what exactly does a day trader do?

What Constitutes Day Trading

At its core, day trading means you buy and sell financial instruments, like stocks or cryptocurrencies, all within the same trading day. You're not looking to hold onto assets for weeks or months; instead, you're trying to catch small price changes that happen over minutes or hours. The goal is to make a profit from these short-term price fluctuations. Think of it as trying to catch a wave – you get in, ride it for a bit, and get out before it crashes. You'll be spending a lot of time glued to your screen, watching market updates and executing trades rapidly. It's a fast-paced world, and you'll need to be quick on your feet. You can explore different approaches to trading, like those discussed in guides on crypto trading strategies.

The Psychology of Day Traders

Beyond just knowing how to click buttons, day trading really tests your mental game. You're constantly making decisions under pressure, and the market doesn't care if you had a bad morning. You need to develop a thick skin because losses are part of the game. Staying calm when things go south and not getting too greedy when things go well is key. It's about sticking to your plan, even when your gut tells you something else. This mental toughness is what separates those who stick with it from those who don't. You'll find yourself discussing investments and trading strategies with others, trying to get an edge.

Common Trading Strategies Employed

Day traders don't just randomly buy and sell. They use specific methods to try and predict market movements. Some common ones include:

- Scalping: This involves making many small trades throughout the day, aiming to profit from tiny price changes. It requires intense focus and quick execution.

- Trend Following: Here, you identify an existing trend (up or down) and trade in that direction, hoping the trend continues. You might use tools like BullX NEO to help spot these trends.

- Range Trading: This strategy involves buying when a security's price hits a support level and selling when it reaches a resistance level, betting that the price will stay within a defined range.

- News Trading: Traders might react to major news events, buying or selling based on how they expect the news to affect prices. This can be very volatile.

Understanding these strategies is just the beginning. You'll need to figure out which ones fit your personality and risk tolerance. It's also worth noting that some traders use automated systems, like trading bots, to help execute their strategies, which can be a way to manage trades based on pre-set parameters how trading bots function.

Factors Influencing Day Trader Success

So, you're thinking about jumping into day trading? It's not just about picking stocks and hoping for the best. A few key things really make a difference in whether you'll see green or red in your account.

Capital Requirements for Day Traders

First off, you need money to make money, right? Day trading isn't cheap. You'll need enough capital to cover your trades, potential losses, and trading fees. Think of it like starting any business; you need startup funds. The amount can vary, but having a solid cushion is important so you don't get wiped out by a few bad trades. It's about having enough to trade actively without constantly worrying about running out of cash. You also need to consider the Pattern Day Trader (PDT) rule if you're trading U.S. stocks, which requires a minimum of $25,000 in your account to make four or more day trades within five business days. This rule is a big deal for many aspiring traders.

The Importance of Market Volatility

Volatility is kind of your best friend and worst enemy as a day trader. High volatility means prices are moving a lot, which creates opportunities for quick profits. But, it also means prices can move against you just as fast, leading to quick losses. You need to find that sweet spot – markets that are active enough to offer chances but not so wild that they're unpredictable. Understanding how to read the market's mood is a big part of the game. Some traders like to track what the big players are doing, and tools like the BullX Wallet Tracker can help you see those movements, but you still need to interpret them yourself.

Risk Management Techniques

This is probably the most important part. You can have the best strategy in the world, but without managing your risk, you're just gambling. This means setting stop-loss orders to limit how much you can lose on any single trade. It also means not putting all your eggs in one basket – diversify your trades. A good rule of thumb is to never risk more than a small percentage of your total trading capital on a single trade, maybe 1-2%. This way, even if you have a string of losing trades, your account can recover. Proper risk management is what separates consistent traders from those who blow up their accounts.

You need a plan for when things go wrong. It's not about avoiding losses entirely, because that's impossible. It's about controlling them so they don't ruin your entire trading career. Think about your exit strategy before you even enter a trade.

Here are some common risk management practices:

- Stop-Loss Orders: Automatically sell a security when it reaches a certain price, limiting your potential loss.

- Position Sizing: Determine how many shares or contracts to trade based on your risk tolerance and account size.

- Diversification: Spread your trades across different assets or sectors to avoid overexposure to any single market event.

- Take-Profit Orders: Set a target price at which to sell a security to lock in profits.

Day trading success is really tied to sticking to these principles. Research shows that traders who are disciplined with their strategies and risk management tend to do better over time. It’s about being smart with your money and not letting emotions get the best of you. You can find more information on day trading strategies in places like Canada's trading scene.

Tools and Technology for Day Traders

So, you're thinking about day trading? You'll need some gear to make it work. It's not just about picking stocks; you need the right setup. Think of it like a chef needing good knives and a clean kitchen. You need tools that help you see what's happening now and make quick decisions.

Leveraging Trading Platforms

First off, you need a place to actually trade. There are a bunch of online brokers out there, and they're not all the same. Some are better for beginners, others have more advanced features. You'll want one that's reliable, has low fees, and gives you the data you need. Platforms like Webull and Fidelity are often recommended for those just starting out, while Interactive Brokers and tastytrade are good for more experienced traders. Picking the right platform is a big step in getting your trading career going.

Utilizing Real-Time Analytics

Watching the market move is one thing, but understanding why it's moving is another. That's where real-time analytics come in. These tools can show you price charts, volume data, and other indicators that help you spot trends or potential shifts. Some platforms have built-in scanners that can alert you to stocks making big moves. Having access to this kind of information helps you make more informed choices, rather than just guessing. Tools like Risk Navigator and Market Scanner can give you a clearer picture of your trading activities.

The Role of Trading Bots

Now, let's talk about automation. Trading bots can be a big help, especially if you can't watch the market all day. One such tool is the BullX NEO trading bot. It's designed to help manage your trades automatically based on rules you set. This can take some of the emotional pressure off and help you stick to your plan. If you're interested in how to get the most out of tools like the BullX NEO DCA tool, there are guides available that explain how to optimize them for better results. You can even get BullX NEO access through specific channels, like their Telegram bot, which can provide updates and alerts. Remember, though, these are tools to assist you, not magic money machines. You still need to understand the market and manage your risk. It's important to know how to get BullX NEO access and use it responsibly.

Day trading requires a specific set of tools to be effective. Without the right software and platforms, you're essentially trying to compete without the necessary equipment. Real-time data, analytical tools, and efficient execution platforms are key components for any serious day trader.

The Financial Realities for Day Traders

So, you're thinking about the money side of day trading? It's a big question, and honestly, the financial realities can be pretty stark. Most people who try day trading don't make a lot of money, and many actually lose it. It's not like a regular job where you get a steady paycheck. Your income can swing wildly depending on the market and how well your trades do. Some sources say only about 1-20% of traders actually see profits, and a tiny fraction, maybe 4%, can actually live off of it. That's a tough statistic to swallow when you're starting out. You might hear stories of traders making big bucks, but for every one of those, there are many more who are struggling. It really comes down to skill, discipline, and a bit of luck. You've got to be prepared for the ups and downs, and that means having a solid plan. Even if you're not profitable right away, many traders keep at it, showing a strong persistence in the community.

Evaluating Day Trader Performance

So, you've been day trading for a bit, maybe you're using something like BullX NEO to help you out. But how do you actually know if you're doing well? It’s not just about whether you made money today or yesterday. You need to look at the bigger picture.

Assessing Trading Account Growth

This is pretty straightforward. You look at your account balance over time. Did it go up? By how much? It’s easy to get caught up in daily wins, but what matters is the trend. Consistent growth, even if it's slow, is usually a good sign. You can track this by looking at your statements or using the reporting features in your trading platform. Seeing your capital increase is a direct measure of your success.

The Impact of Trading Fees

Don't forget about the costs. Every trade you make, whether it’s a win or a loss, usually comes with fees. These can be commissions, exchange fees, or even data costs. If you're trading frequently, these can really add up and eat into your profits. It’s important to know what these fees are and how they affect your net earnings. Sometimes, a trade that looks profitable on paper might actually be a loss once you factor in all the costs. You can check out resources that help assess market conditions to see if the market is currently overvalued or undervalued, which can indirectly impact your fee efficiency.

Comparing Day Traders to Other Investors

It’s also useful to see how you stack up against broader market performance. Are you doing better than just putting your money in a broad market index fund? Most professional traders don't aim for the same returns as, say, a long-term buy-and-hold investor. Their strategies are different, and so are their risk levels. Remember, professional traders often achieve profitability with win rates around 60% or lower, focusing on a good risk-reward ratio where profits from winning trades significantly outweigh losses. It’s about managing risk and making sure your winning trades are bigger than your losing ones. You might also find that with consistent practice, noticeable improvements can start to show after about 50 trading days highlighting the importance of early and consistent practice.

You need to be honest with yourself about your results. Are you consistently making good decisions, or are you just getting lucky? Tracking your performance metrics, understanding your fees, and comparing your results to benchmarks are all part of becoming a better trader.

Figuring out how well a day trader is doing can be tricky. You need to look at more than just wins and losses. It's about understanding their strategy and how they handle different market ups and downs. Want to learn more about how to measure trading success? Visit our website to discover the tools and insights that can help you track your own trading performance.

So, Do Day Traders Make Money?

After looking at all this, you might be wondering if day trading is really for you. It's not as simple as just picking stocks and hoping for the best. Most people who try it don't end up making a lot of money, and many actually lose what they put in. It takes a lot of time to learn, and you need to be really good at managing your money and staying calm when things get wild. Tools like BullX NEO, which offers fast trading and analytics, can help, but they don't guarantee success. If you're thinking about it, be prepared to study hard and understand the risks. It's definitely not a get-rich-quick scheme.

Frequently Asked Questions

What exactly is day trading?

Day trading is when you buy and sell stocks or other financial stuff within the same day. You're not holding onto them overnight, aiming to make quick profits from small price changes.

Do most day traders actually make money?

It's tough! Most people who try day trading lose money. It takes a lot of skill, discipline, and understanding of how the markets move. Think of it like trying to become a pro athlete – only a few make it big.

How much money do you need to start day trading?

You need a good chunk of money to start, often thousands of dollars, because you need enough to trade with and to cover any losses. Plus, you need to make sure you have enough to live on while you're learning.

What kind of tools do day traders use?

You'll need a computer with a fast internet connection, a reliable trading platform like BullX NEO which lets you trade easily on your phone too, and tools that give you live market data. Staying updated is key!

Can trading bots help day traders?

Sure, trading bots can help! Platforms like BullX NEO offer bots that can trade for you, plus they give you cool charts and info to help you make better choices. They can speed things up and help you trade on different blockchains.

How do day traders handle risk?

It's super important to manage your risks. This means not putting all your money into one trade, setting limits on how much you're willing to lose on a single trade, and knowing when to walk away. It's all about protecting your cash.

More BullX NEO Guides: