BullX NEO Strategy: How to Master the DCA Tool

BullX NEO - Best Solana Trading Bot

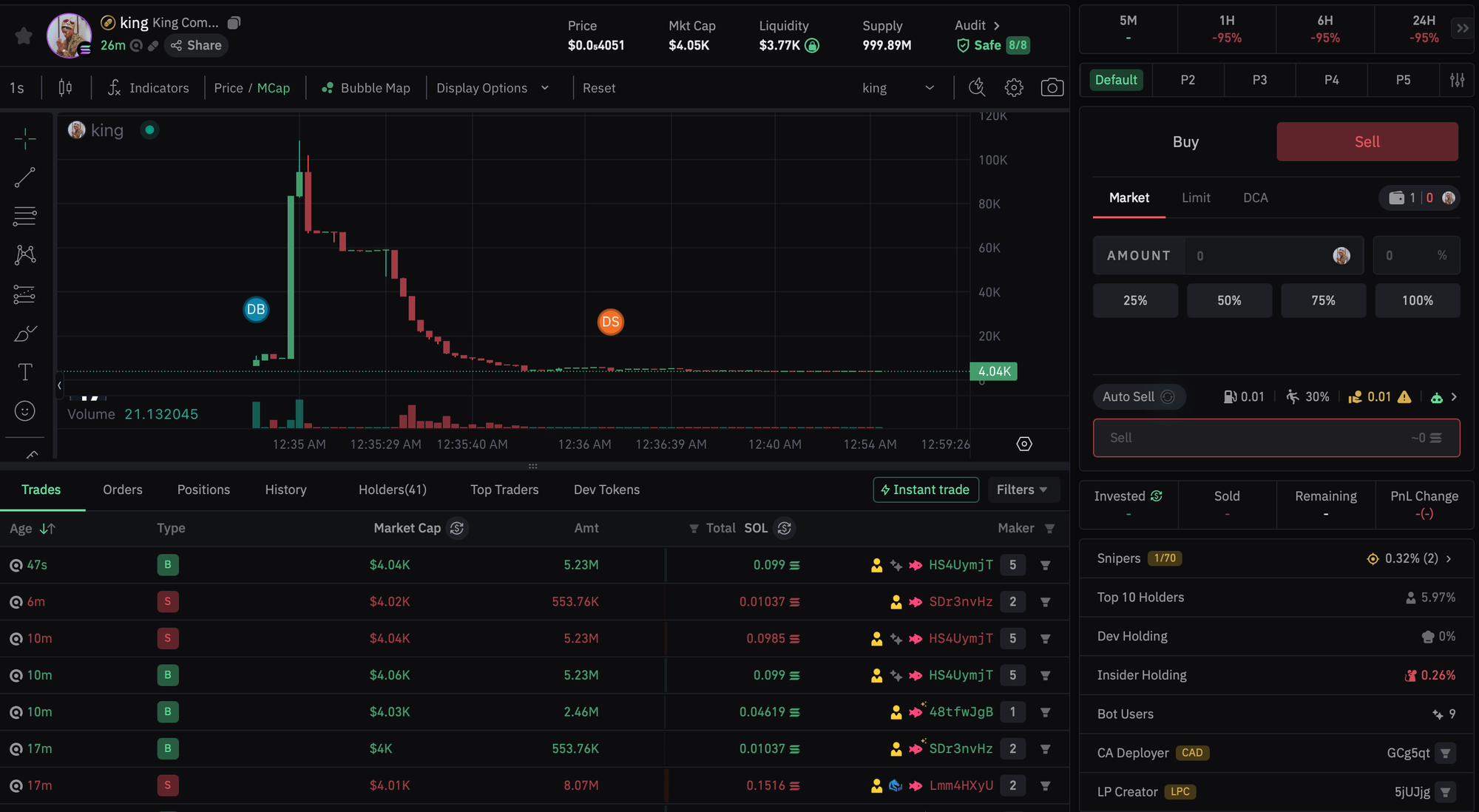

In the world of high-speed Solana trading, automation is key to executing trades efficiently and managing risk effectively. BullX NEO, the fastest Solana trading bot, offers a powerful Dollar-Cost Averaging (DCA) tool that allows traders to automate their buys and sells based on pre-set conditions.

Instead of manually timing entries and exits, the BullXNEO DCA tool enables users to:

- Auto-buy tokens at specific intervals (e.g., every 10 minutes);

- Pre-set market cap conditions to control when purchases occur (e.g., only buy when market cap is between $1M and $2M);

- Auto-sell tokens at defined price points, ensuring profit-taking before a market reversal.

This guide will explain how to set up and optimize BullX NEO’s DCA tool for maximum efficiency in trading Solana tokens. Whether you're sniping new launches, swing trading, or holding long-term, learning to master this automation feature will give you a significant edge over manual traders.

Check out BullX NEO and explore the fastest trading automation available today.

What is the DCA Tool in BullX NEO?

The Dollar-Cost Averaging (DCA) tool in BullX NEO is an advanced automation feature designed to:

- Execute automatic buy and sell orders at regular intervals;

- Allow traders to enter positions gradually, reducing risk in volatile markets;

- Customize purchases based on market cap conditions, preventing high-entry buys.

Example of how the DCA tool works:

Imagine you want to invest in a new Solana token but only if its market cap is between $1M and $2M. Instead of manually tracking the price, you can pre-set BullX NEO to buy 1 SOL worth of the token every 10 minutes, but only while the token’s market cap is within the specified range.

Similarly, you can pre-set auto-sell triggers to automatically take profits at various price milestones. For example, you might set BullX NEO to sell 50% of your holdings at $5M market cap, another 25% at $7M, and the rest at $10M.

Key Features of the BullX NEO DCA Tool:

- Auto-buy based on a custom timeline (e.g., buy every 10 minutes, every hour, or daily);

- Auto-sell at pre-set market cap levels (e.g., take profits at $5M, $10M, and $15M);

- Prevent bad entries by restricting buys to a specific market cap range;

- Remove emotions from trading and let the best solana telegram bot execute trades for you.

Why Use DCA?

- Eliminates human error and emotional trading;

- Allows traders to enter positions gradually, reducing risk from sudden price swings;

- Ensures profits are secured without manually monitoring the market 24/7.

Here you can find out more features about the best trading bot for Solana: BullX NEO

How to Set Up Auto-Buy with the BullX NEO DCA Tool

Setting up Auto-Buy in BullX NEO allows traders to accumulate tokens in a structured and automated manner, ensuring they buy at the best market conditions without constantly monitoring price charts.

By defining specific buying intervals and market cap conditions, traders can avoid overpaying for tokens, reduce exposure to extreme volatility, and execute a disciplined, emotion-free trading strategy.

This feature is especially useful for:

- New token launches, where price swings are unpredictable;

- Long-term accumulation strategies, where gradual buying prevents buying tops;

- High-speed Solana trading, where precise market cap-based buying can maximize entries.

Step-by-Step Guide to Setting Up Auto-Buy in BullXNEO

1️⃣ Open BullX NEO in Telegram and type /settings to access the settings menu;

2️⃣ Navigate to DCA Settings and select Auto-Buy to begin configuring the feature;

3️⃣ Set Your Buy Frequency:

- Choose how often you want BullX NEO to execute buys;

- Options include:

- Every 5 minutes → Best for ultra-high-frequency sniping.

- Every 10 minutes → Ideal for aggressive accumulation.

- Every hour → A balanced approach for gradual DCA.

- Once per day → Best for long-term accumulation.

4️⃣ Define Your Market Cap Conditions:

- Prevent overpaying by only allowing purchases within a certain market cap range;

Example: Set BullX NEO to only buy if the token’s market cap is between $1M and $2M; if the token pumps beyond $2M, Auto-Buy pauses automatically, ensuring you don’t enter at inflated valuations, but if the market cap drops back within range, the DCA strategy resumes purchases.

5️⃣ Choose the Purchase Amount Per Cycle:

- Define how much SOL to allocate per buy order;

This method avoids going all-in at a single price, helping reduce exposure to temporary spikes or whale-driven manipulation.

6️⃣ Enable & Save Your Auto-Buy Settings:

- Once activated, BullX NEO will execute the Auto-Buy strategy exactly as configured.

- The bot will only buy when your market cap and time conditions are met, and it will pause automatically if market conditions change.

Why Auto-Buy is a Game-Changer for Solana Traders

The primary advantage of Auto-Buy is its ability to eliminate the stress of market timing. Instead of trying to manually enter a position at the "perfect" price, BullXNEO ensures that your trades are executed systematically, reducing the risk of buying at an overinflated price.

By spreading buys over time, traders can take advantage of market fluctuations rather than being forced into a single, all-in entry. This method is particularly effective when trading highly volatile Solana tokens, where short-term price swings can be extreme.

How Auto-Buy Prevents Common Trading Mistakes

- Avoids FOMO-based buying – You never chase pumps or enter at the worst possible moment;

- Removes human error – Pre-set conditions ensure trades execute objectively;

- Reduces exposure to extreme volatility – Instead of buying all at once, funds are deployed over time;

- Works in both bullish and bearish conditions – If the token dips temporarily, Auto-Buy continues accumulating at lower prices.

For traders looking to build a strong position over time, Auto-Buy is an essential tool in BullX NEO’s arsenal. It allows for consistent accumulation without emotional decision-making, making BullX NEO the best telegram bot.

How to Set Up Auto-Sell with the BullX NEO DCA Tool

While Auto-Buy helps traders accumulate positions strategically, Auto-Sell ensures profits are locked in at optimal levels. With BullXNEO’s DCA Auto-Sell tool, traders can set predefined sell intervals based on market cap targets, ensuring they secure gains at the right time without needing to monitor price charts 24/7.

Using Auto-Sell, traders can:

- Sell gradually at different market cap milestones instead of dumping all at once;

- Secure profits automatically before price reversals occur;

- Customize sell percentages to take profits while keeping some exposure to potential further price increases.

Step-by-Step Guide to Setting Up Auto-Sell in BullX NEO

1️⃣ Open BullX NEO in Telegram and type /settings to access the settings menu.

2️⃣ Navigate to DCA Settings and select Auto-Sell.

3️⃣ Set Your Market Cap Ranges for Selling:

- Define when the bot should start selling your holdings based on market cap targets.

- Example:

- Sell 50% at $5M market cap.

- Sell 25% at $7M market cap.

- Sell the remaining 25% at $10M market cap.

4️⃣ Customize Your Sell Percentage Per Range:

- Unlike a full exit, BullX NEO allows you to DCA your sells, meaning you can take profits gradually;

- This ensures that you profit while still maintaining exposure to further upside potential.

5️⃣ Enable and Save Auto-Sell Settings:

- Once saved, BullX NEO will automatically sell your tokens at your pre-set conditions;

- If the token doesn’t reach your set market cap sell ranges, the bot won’t sell, ensuring you don’t exit prematurely.

Why Auto-Sell Maximizes Profitability

The biggest mistake traders make is failing to take profits at the right time. Many traders hold on too long, expecting prices to keep climbing, only to watch their gains disappear when the market reverses. BullX NEO’s Auto-Sell feature prevents this by ensuring disciplined, automated exits.

Best Market Cap Ranges & Strategies for DCA

Choosing the right market cap ranges for Auto-Buy and Auto-Sell is key to optimizing profit potential while minimizing risk. The best strategy depends on whether you’re trading low-cap gems, mid-cap movers, or high-cap tokens.

Here are some recommended market cap ranges based on different trading styles:

1. Early-Entry Sniper Strategy

- Buy range: $500K - $2M market cap (accumulate before the pump).

- Sell range: $5M - $10M market cap (lock in profits gradually).

- Why?

- Low entry, high exit potential.

- Avoids chasing tokens that have already pumped.

2. Mid-Cap Holding Strategy

- Buy range: $2M - $5M market cap (accumulate during stability).

- Sell range: $15M+ market cap (longer-term target).

- Why?

- Targets tokens that have room to grow but aren’t in early-stage risk zones.

- Reduces exposure to low-liquidity projects.

3. Scalping Strategy

- Buy every 5 minutes.

- Sell every 30 minutes based on price movement.

- Why?

- Maximizes quick gains on volatile price swings.

- Best for fast-moving tokens like those launched on Pump.fun.

Common Mistakes to Avoid When Using the DCA Tool

Even though BullX NEO automates trading, mistakes can still happen if DCA settings aren’t optimized correctly. Here are the top mistakes to avoid when using Auto-Buy and Auto-Sell:

optimized correctly. Here are the top mistakes to avoid when using Auto-Buy and Auto-Sell:

- Buying too frequently without considering liquidity -> set reasonable buy intervals to avoid market slippage and overpaying;

- Not setting stop-loss protection alongside Auto-Sell -> use stop-loss automation to exit early if a token starts dumping unexpectedly.

- Allocating too much capital into one DCA strategy -> diversify across multiple tokens to reduce risk exposure;

- Failing to adjust market cap conditions over time -> Regularly update your settings as market trends evolve.

FAQs: Mastering the BullX NEO DCA Tool

Traders new to BullX NEO’s DCA tool often have questions about how to optimize settings for better profitability and risk management. Below are some of the most frequently asked questions and expert answers to help you get the most out of automated trading.

How does the DCA tool prevent bad trades?

The BullX NEO DCA tool prevents poor trade execution by allowing users to pre-set strict buy and sell conditions. Instead of executing trades randomly, the bot only buys within your chosen market cap range and follows your timing intervals.

Can I run multiple DCA strategies at once?

Yes! BullX NEO supports multiple active DCA strategies, allowing traders to customize different buy/sell ranges across multiple tokens.

For example, you could:

- Run a high-risk sniper strategy for new tokens with a buy range of $500K-$2M market cap.

- Run a mid-cap holding strategy with a $2M-$5M buy range and a $15M+ sell target.

- Use a scalping strategy with frequent buys and quick flips every 30 minutes.

What's the best frequency for Auto-Buy?

The ideal buy frequency depends on the volatility and liquidity of the token. Here’s a general guide:

- Low-volatility tokens (stable projects) → Buy every 1-6 hours for gradual accumulation.

- Medium-volatility tokens (new mid-cap projects) → Buy every 10-30 minutes for strategic accumulation.

- High-volatility tokens (new launches, Pump.fun tokens) → Buy every 5 minutes for aggressive sniping.

Should I always sell everything at once, or use Auto-Sell?

Selling everything at once can cause massive price slippage, especially in low-liquidity tokens. Using Auto-Sell with pre-set market cap targets allows traders to exit gradually, ensuring profits are taken without crashing the price.

What’s the best way to test my DCA settings before committing?

The best way to test DCA settings is by:

1️⃣ Running a small test trade first (e.g., using 0.1 SOL instead of full size);

2️⃣ Monitoring how the Auto-Buy and Auto-Sell executions perform;

3️⃣ Adjusting market cap conditions, buy intervals, and sell targets if needed;

4️⃣ Slowly increasing position size once the strategy is working effectively.

Mastering BullX NEO’s DCA tool can give traders a huge edge in the fast-moving Solana trading market. By automating buy and sell strategies, users can remove emotions from trading, secure better entries, and take profits without constantly monitoring charts.

Whether you’re sniping new launches, swing trading mid-cap tokens, or scaling into long-term plays, BullX NEO’s automation ensures disciplined execution.

Want to learn more? Check out these related guides:

📌How to copy trade using BullXNEO

📌 How to Avoid Rug Pulls Using BullX NEO’s NEO Vision

📌 BullX NEO's referral program explained