A Day in the Life of a Pro Crypto Trader

Ever wondered what a typical day looks like for someone making a living trading crypto? It's not all Lambos and private jets, you know. For a crypto trader, it's a mix of early mornings, constant market watching, and smart tool use. Let's walk through a day to see how it all goes down.

Key Takeaways

- Start your day by checking the crypto news and getting a feel for the overall market direction.

- Review your current crypto holdings and see how they've performed since yesterday.

- Use trading platforms like BullX NEO for quick trades and access to real-time data.

- Keep an eye on how you're managing your risk and look for new opportunities as the market shifts.

- At the end of the day, look back at your trades to learn what worked and what didn't for tomorrow.

Morning Routine Of A Crypto Trader

Your day as a crypto trader starts early. The first thing you do, even before coffee, is check the market. It’s not about making trades right away, but about getting a feel for what’s happening. You’ll want to see how the major coins are performing and if there are any big price movements overnight. This initial scan sets the tone for your entire trading day.

Market Overview And News Scan

When you wake up, the crypto world never really sleeps. You need to get a handle on the overnight action. This involves looking at price charts for Bitcoin, Ethereum, and other coins you follow. You also scan major crypto news outlets and social media for any significant announcements or events that could impact prices. Think about regulatory news, major project updates, or even macroeconomic factors. It’s about piecing together the puzzle of what might move the market today. You might even check out the bullx neo telegram bot for quick updates.

Portfolio Check And Performance Review

After the initial market scan, you turn your attention to your own holdings. How did your positions perform overnight? Are there any trades that are currently in profit or loss? This isn't just about looking at the numbers; it's about understanding why certain assets are moving. You’ll review your open positions and consider if any adjustments are needed based on the morning’s news and market sentiment. It’s also a good time to check your overall portfolio balance and see how it aligns with your goals. Remember, maintaining a clear head is important, so taking a moment for some deep breathing can help before you start making decisions. Trading psychology plays a big part here.

A structured morning routine helps you approach the trading day with a plan, rather than reacting impulsively to market fluctuations. This discipline is key to long-term success.

Navigating The Trading Day

Once the morning market overview is done, it’s time to get into the actual trading. This part of the day is all about action and quick thinking. You’ll be executing trades, keeping an eye on how things are moving, and making sure your different crypto holdings are in order.

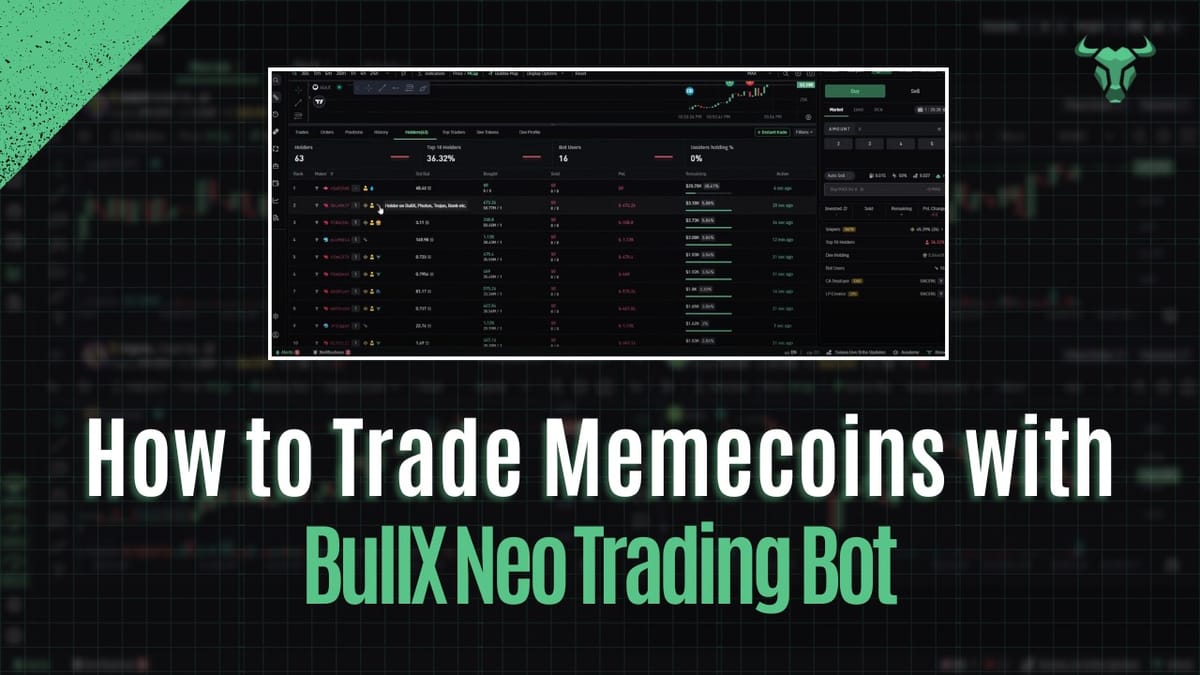

Executing Trades On BullX NEO

When you’re ready to make a move, platforms like BullX NEO are where it happens. You’ll be placing buy and sell orders, aiming to capitalize on price changes. It’s important to be precise here; a misplaced decimal can make a big difference. You might be using strategies like day trading, which focuses on short-term gains within 24 hours, or perhaps swing trading to profit from emerging market trends. The key is to act decisively based on your analysis.

Utilizing Real-Time Analytics

To make smart decisions, you need data. This means looking at charts, order books, and news feeds as they update. You’ll be watching price action closely, often using time frames like 15-minute or 30-minute charts to spot opportunities. Understanding these real-time analytics helps you react quickly to market shifts.

Managing Multiple Wallets

As a crypto trader, you probably have funds spread across different wallets for security or organizational reasons. During the trading day, you might need to move assets between these wallets, perhaps to fund a trade on BullX NEO or to secure profits. Keeping track of everything requires a good system, so you know exactly where your assets are and how much you have available for trading.

Midday Market Analysis

By midday, you’ve likely executed some trades and have a feel for the market’s direction. This is a good time to pause and really look at what’s happening. You want to see if the initial trends you spotted are holding up or if things are shifting.

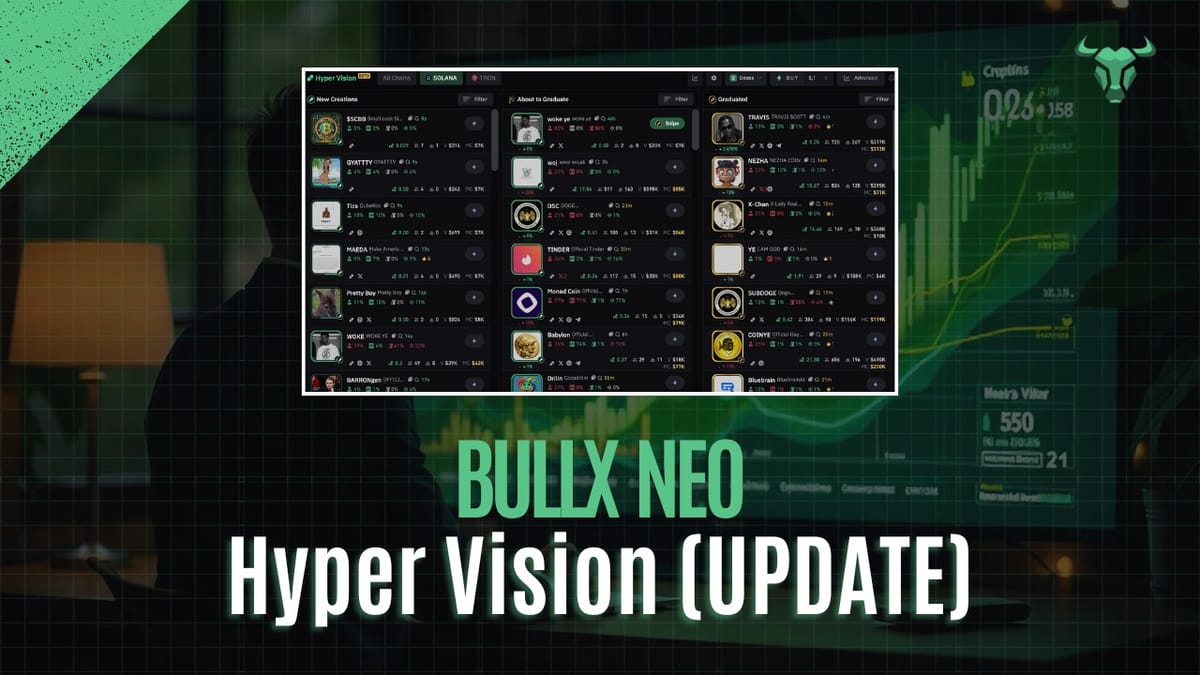

Identifying Emerging Trends

Look at the charts on your platform, like BullX NEO. Are certain coins showing consistent upward or downward movement? Sometimes, you’ll see a momentum build in a particular sector or type of coin. For instance, you might notice a few new meme coins suddenly gaining traction, or perhaps utility tokens are starting to outperform. Keep an eye on trading volumes too; a sudden spike can signal a significant shift. It’s about spotting these patterns before they become obvious to everyone else. This is where tools that help you track wallet activity can be really useful, showing you where the smart money might be moving.

Assessing Risk Management Strategies

Now is also the time to check if your risk management is still on track. Did you set stop-losses? Are they still appropriate given the current market action? If you’re using strategies like range trading, are the support and resistance levels still holding? It’s easy to get caught up in the excitement of a trade, but a quick review of your risk parameters is important. Don't let your initial plan get lost in the noise. If a trade isn't going as expected, it might be time to cut your losses or adjust your position. Remember, protecting your capital is just as important as making profits. You can review your performance on BullX NEO to see how your risk management is playing out in real-time.

Afternoon Trading Strategies

As the afternoon rolls in, the market can shift, and you need to be ready. This is often a good time to look at how your morning trades played out and adjust your approach. It’s about staying flexible and using the tools you have to your advantage.

Leveraging Telegram Bot For Trades

Many traders use Telegram bots to help manage their trades. These bots can alert you to specific price movements or even execute trades based on pre-set conditions. For instance, you might set up a bot to notify you if a certain coin's price breaks out of a range, allowing you to react quickly. Some bots can even execute trades directly on platforms like BullX NEO, saving you time and ensuring you don't miss opportunities. It’s a way to keep an eye on the market without being glued to your screen all day. You can set up alerts for specific market cap ranges or even for when a token hits a certain buy frequency, which is a feature of the BullX NEO DCA tool.

Adapting To Volatile Conditions

Cryptocurrency markets are known for their swings. When things get choppy, it’s important not to panic. Instead, focus on your risk management. This might mean reducing your position sizes or sticking to more conservative strategies. Range trading, for example, can be effective when the market isn't trending strongly in one direction. This involves identifying support and resistance levels and trading within that defined channel. You're essentially betting that the price will bounce between these levels, a strategy that requires careful observation of price action.

When the market gets wild, remember your plan. Don't let emotions dictate your decisions. Stick to your stop-losses and take-profit targets. It’s better to make smaller, consistent gains than to risk it all on one big, potentially losing, trade.

End Of Day Review For A Crypto Trader

As the trading day winds down, it’s time to take stock. You’ve been glued to the screens, making moves, and now you need to see how it all shook out. This isn't just about checking your profits; it's about learning from the day's activity to get better.

Analyzing Trade Performance

First up, let's look at your trades. Did you stick to your plan? Were there any impulsive decisions that cost you? It’s important to be honest with yourself here. You can review your trade history, perhaps on a platform like BullX NEO, to see which trades were winners and which were losers. Note down the reasons for each trade, both the good and the bad ones. This helps you spot patterns in your own behavior. For instance, you might notice you tend to chase pumps or panic sell during dips. Understanding these tendencies is key to improving your results. You can also look at the performance of different assets you traded. Did Bitcoin outperform Ethereum today? Why might that be?

Planning For The Next Trading Session

After reviewing today’s performance, you need to set yourself up for tomorrow. What did you learn that needs to be applied? Maybe you need to adjust your stop-loss levels or focus on a specific type of coin. If you used the bullx neo trading bot, check its performance and any adjustments you might need to make. You might also want to scan the news again for any overnight developments that could impact the market. Thinking about potential market movements and how you'll react is a good way to prepare. This is where you can really start to see how your strategy evolves. For beginners, understanding the basics of crypto day trading is a good place to start for beginners.

Looking back at your trades, even the losing ones, provides a roadmap for future success. It’s not about dwelling on mistakes, but about extracting lessons that will refine your approach. This reflective process is what separates consistent traders from those who just gamble.

Tools And Platforms For Success

To really do well in crypto trading, you need the right gear. It’s not just about knowing what to buy and sell; it’s about having the systems in place to do it efficiently and safely. Think of it like a carpenter needing good tools – you can’t build a house with just your hands.

The Role Of Multi-Chain Platforms

These platforms are becoming really important. They let you interact with different blockchains all from one spot. This means you can manage assets across various networks without jumping between different apps. For example, you might want to move funds from a DeFi protocol on Ethereum to a different network for lower fees. A good multi-chain platform makes this much simpler. Having this kind of flexibility is key to staying ahead. It helps you access more opportunities and react faster to market changes. You can find some of the best crypto trading tools available that support this multi-chain functionality.

Benefits Of A Seamless Trading Experience

What does a seamless experience actually mean? It means your trades go through without a hitch, your data is clear and easy to understand, and you don't waste time fighting with clunky interfaces. When you’re using a platform like BullX NEO, you want to be able to execute trades quickly, check your portfolio performance, and access market data without any delays. This smooth operation saves you money by reducing slippage and missed opportunities. It also cuts down on stress, which is a big deal in such a fast-paced market. Choosing the right broker also plays a part in this; some platforms are better suited for active traders, while others are great for beginners. You can compare top trading software and brokers to find what fits your style best for your needs.

Managing your digital assets effectively means having the right infrastructure. This includes not only the trading platform itself but also how you secure your funds and access information. Think about how you'll handle different types of transactions and what tools will help you do that without errors. It's about building a reliable system that supports your trading goals.

Here are a few things to look for:

- Speed: How fast can you enter and exit trades?

- Data Accuracy: Is the market data you're seeing up-to-date and reliable?

- Security: How are your funds and personal information protected?

- User Interface: Is the platform intuitive and easy to navigate?

Having these elements in place helps you focus on the actual trading, rather than troubleshooting your tools. It’s about making your trading day as productive as possible. You can discover crypto trading bots that help manage your portfolio and save time, potentially boosting your gains with these helpful tools.

Looking for the best tools to help you succeed? We've got you covered with platforms designed for speed and ease. Discover how our solutions can boost your trading game. Visit our website today to learn more and get started!

Conclusion

So, that's a look at what a day might be like. It's not always easy, and you'll see there's a lot to keep track of. Things move fast in crypto, and you need to be ready for anything. Tools like BullX NEO can help make things simpler, especially with its Telegram bot and real-time data. But remember, trading takes work and practice. Don't expect to master it overnight. Keep learning, stay sharp, and manage your risks. You'll get there.

Frequently Asked Questions

What's the first thing you do in the morning as a crypto trader?

Think of it like checking the news! You'll want to see what's happening in the crypto world, like if a coin's price is going up or down, and if there's any big news that might affect it. This helps you figure out what to do next.

How do you check your crypto investments?

You'd look at your digital piggy bank, your portfolio, to see how much money you have and if your investments are making you more money or losing some. It’s like checking your grades to see how you’re doing.

What is BullX NEO and why is it special?

BullX NEO is a cool tool that lets you trade crypto easily, especially fun meme coins, using the fast Solana network. It’s like having a super-fast, easy-to-use game controller for trading, and it works on your phone through Telegram!

Why is managing multiple crypto wallets important?

Imagine having lots of different digital wallets for your crypto. You'd need a way to manage them all without getting confused, right? Platforms that let you handle many wallets at once make trading smoother.

How do you figure out what crypto to buy or sell?

You'd use special tools that show you charts and numbers in real-time. This helps you spot when a coin might be getting popular or when the market is a bit wild, so you can make smart moves.

What does 'managing risk' mean in crypto trading?

It means being careful with your money. You don't want to bet everything on one coin. Spreading your investments around and knowing when to stop trading if things get too risky is key to not losing too much.

More BullX NEO Guides: